Search This Blog

Saturday, December 27, 2008

Monitoring Hard Disk Conditions

Introduction

Very often, one faces the problem of computer failing to start up; sometimes, the computer just hanged and may even re-start itself before it reaches the usual welcoming start up screen. Besides a virus that can cause such problem, the harddisk's condition could just be another one of such causes.

Can We Prevent Harddisk Failure?

Harddisk failure is either caused by component failures due to electric surges or by damaged harddisk media due to normal fair wear and tear. The latter appears to be main cause of all problems. One of the many ways that we can prevent a harddisk failure is to monitor the harddisk's working condition, especially its operating temperature.

How to Monitor?One can download this S.M.A.R.T software free from here.

What is S.M.A.R.T?It stands for "Self-Monitoring, Analysis, and Reporting Technology", first introduced by IBM in 1992. S.M.A.R.T will monitor about 40 different attributes of the harddisk from read and seek errors to airflow temperature in and around the harddisk.

How useful?Among the many attributes monitored, one would find the temperature monitoring most useful. Very often, one neglects the proper ventilation of the harddisk. This S.M.A.R.T software can continuously monitor the temperature and warns us if the temperature has exceeded the preset level. This would often prevent premature harddisk failures.

Besides temperature monitoring , the software can scan harddisk surface and display the results in graphs. This will facilitate the repair and the revival the harddisk. The software could also point out the data transfer errors caused by faulty cables etc.

How to install?The HDDScan software to be download comes with installation readme notes as well as manuals for the installation and operation of the software. There are no complicated installation procedures other than having to extract the ZIP files into a selected directory.

Related articles

1. S.M.A.R.T. Wikipedia, the free encyclopedia

2. HDDScan, the HDDGuru

Friday, December 26, 2008

A Period of Indecision in STI

IntroductionOne will heard endless arguments about where STI will move in the coming weeks. Some will say that a plunge is imminent while others will disagree. This is all because STI has entered a period of indecision.

Progress Todate

STI has plunged more than 54% since October 2007. It has just recovered about 8% or 130 points from its low at 1,613 on 20 November 2008. It has been moving sideway ever since and is presently trapped in a symmetrical triangle formation as shown in the attached graph.

Going Forward

Presently, US has been reporting very poor economy figures; the Singapore's economy figures are not any good either. Many analysts, including Mr. Daryl Guppy, had projected selling pressures in STI although they were not too sure of the exact market movement next because of the symmetrical triangle being formed in the STI's chart.

Mr. Guppy had 2,300 on the upside and 1,250 on the downside.

What the Chart is Telling Us?

The above daily chart shows the symmetrical triangle that Daryl Guppy has mentioned. The chart is also telling us that:

Bearish looks:a) STI has formed another bear flag with its based at 1,600;

b) It tried twice recently but failed to break the upper triangle trendline

Bullish looksa) Its 20-day MA is rising and the 50-day MA, flattening out; the 20-day MA is about the cross the 50-day MA;

b) It's Stochastic has reached the oversold region.

Neutral looksa) It's volume is thinning out as it goes sideways or slightly lower;

Future MovementsThe chart also tells us the future movement; for example:

a) Heading lower when the lower trendline of the symmetrical triangle is broken.

If the last low of 1,600 support is also broken, STI will want to target for 1,250, which is the equal length measured from the 1,600 base of the flag pole to its last high. If this target of 1,250 is broken again, the next target is likely to be around 1,050.

b) Heading higher when the upper trendline is broken.

If the top of the Bollinger Band (shown dotted in red) is broken, it will want to target for the 100-day MA line. Next, it will target for the 200-day MA line which happens to be the trendline of the peak since October 2008 (shown blue in the chart)

However, for both events to happen, there must be also a surge in the trading volume; otherwise, STI might just continue its sideway movement, much like the breakout of the triangle on 9 December 2008 (shown dotted in blue)

Disclaimer:

Information here is for sharing and learning. It is not intended to give any advice on any stock or movement or trend of any index. If a price or movment of a stock/index is given, it is only intended for illustration. The reader shall verify the information given here before using them.

Saturday, December 20, 2008

How to Revive Faulty Hard Disk

20 December 2008

Introduction

There are many reasons why computer always hang or run slowly or sometimes, even re-start itself. One of reasons can be traced to the harddisk failure. Normally, one would repair the harddisk by recovering the bad sectors using "Chkdsk" in the "Windows Recovery Console". However, there will be times that even this method won’t help. This article will describe another method to revive that harddisk.

How Long the Harddisk will last After the Revival?

It will depend on the condition of the harddisk. If the harddisk had a crash, there is a good chance that the harddisk will not last too long before it will fail again. Therefore, it is good to make a safe copy of the important data in the harddisk whenever possible.

Harddrives are quite cheap nowaday; it will make good sense to replace rather than to repair or revive them. But if one had decided to give the revival a try, this article will describe one method.

What’s needed?

1. Low Level format software (free to download from here)

2. Partitioning software such as Partition Magic or equivalent

Step by Step Procedures

Using PartitionMagic

a) Non Destructive Method

This method will make use of the PartitionMagic to create a new partition to isolate the bad section and to use the healthy part of the harddisk.

The method will retain most of the applications and programs in the harddisk. One might have to perform a low level format describe in Section (b) when there are too many bad sectors in the harddisk.

1. Estimate where to create this partition

When performing "Chkdsk" operation, observe the progress counter and note down its percentage when Chkdsk got stuck. The following example will assume that the counter got stuck at 75% while checking D: drive.

2. Start up PartitionMagic

One would be greeted by this screen that shows all the partitions in the harddisk.

3. Create New Partition

Select to “create new partition” in the “Wizard” and after answering a few questions about how to use new partition and the type of file system, one would come to the following screen where one would have to specify the location for the new partition.

Since the Chkdsk counter was stuck at 75% when scanning D: drive and D: has 50 GB, one would like to create a new partition between D: drive and E: drive and take about 35-40% off from D: drive to make this new partition. One might have to release some space in D: drive if it is full. New partition can only be created from free and unused disk space.

In case when error is encountered during the process of creating a new partition, either try to resize or erase the new partition, then assign a smaller size of partition to isolate the faulty session,

Click “Finish” and subsequently, click “Apply Change” to make the changes. Thereafter, format the entire disk so that a drive number can be assigned to the new partition just created.

4. Check For Errors

Check the various partitions for errors using the utility programs available under the “operation” menu of the PartitionMagic. Resize the new partition and recheck for error if necessary.

(Note: The above example assumed that the harddisk is still working with some errors in one section. If the faulty harddisk cannot start properly, one would have to hook the harddisk as a slave. The latter is always recommended because one might have to tweak the size of the new partition to locate the faulty section and it would save the trouble of re-starting the computer to change the partition sizes)

Other Tools (Updated 1 May 2021)

MiniTool Partition

1. Download free software from here

2. Similar to MagicPartition, this MiniTool software can also perform the same tasks. The paid versions can also backup & recover data

b) Destructive Method: Low Level Format

When there are too many bad sectors or faulty sections in the harddisk, it is always good to backup the important data and perform a low level formatting. This low level formatting will always require the faulty drive to be hooked up as a slave drive.

1. Download the low level format program from here.

2. After installation, run “LLFTOOL.EXE” and follow the instruction to select the faulty drive and then select low level format page.

Double confirm the correct faulty drive before you press the button “FORMAT THIS DEVICE” because all data in the drive will be erased and gone permanently.

3. Create new partitions and reformat the harddisk as if it is a new harddisk

4. Reinstall operating system and the rest of the applications/software

Note: If one still encounters problem, one can go through the Section (a) again to isolate the faulty sections.

Related Articles

1. Repair Damage Master Boot Record & Boot Sectors

2. Replacing the Hard Disk

Thursday, December 18, 2008

VIX, DOW and Market Movement

IntroductionThe Volatility Index, commonly known as VIX, is a Futures stock index traded in the Chicago Stock Exchange. It is often referred to as the barometer of investors’ confidence in equity market. It indicates the investor sentiment and market volatility. A higher VIX will indicate a lower DOW and vice versa.

What happened to VIX lately?

The attached chart shows that VIX was having very volatile trades lately; it climbed from $20 on 1 Sept 2008 to $80 on 27 October 2008, a hefty $ 60/= or 300% jump, which had never been seen before since 1993 when VIX was first introduced. Then it made a double top formation and plunged 40% to the present level of about $50 through volatile trades.

What's the use of VIX?

VIX has volatile trades; hence, it is good gauge to judge the movement of the equity markets, which usually have less volatile trades that make future prediction difficult.

Where Can I Get Free Quotes?One can get free quote of VIX from here and DOW from here.

Where is VIX Heading?

The attached chart shows many weaknesses of VIX; for example:

a) It has just formed a double top formation and is presently declining from its second peak;

b) It's 20 MA (green) is about to cross under the 50 MA(blue), meaning VIX is about to start its decline;

c) The top and bottom Bollinger bands are falling together with falling 20 MA and flattening 50 MA;

d) The stochastic is showing a “falling peak” with VIX dropping steadily into the oversold region. There are still rooms for further declines.

The above weaknesses will show that VIX is presently under heavy selling pressure. One should soon see VIX started to yield once it crosses below the double top support (red) at around $48.

According to rule of thumb, once VIX crosses under the double top support, it will target for $15, which a projection from the base double top support, using equal length measured from the tip of the double top to the base support.

Where would DOW be then?

There is no direct co-relationship between DOW's and VIX’s movement. But if there is any indication at all, DOW will move up when VIX is moving down. However, if the projection of VIX is correct with a target of $15, DOW may be targeting around or max out at 13,000. But to reach that level, DOW would have to break several resistances including the one at 200 MA, which could be a "tough nut to crack" unless DOW is supported by very good news and economy figures.

Disclaimer:

Information here is for sharing and learning. It is not intended to give any advice on any stock or movement or trend of any index. If a price or movment of a stock/index is given, it is only intended for illustration. The reader shall verify the information given here before using them.

Thursday, December 11, 2008

The US National Debts

Introduction

The US Congress has just approved the bills to bailout the Wall street's Banking sector, then AIG, the insurance sector and now the 3 big autos in the automobile industry. These bailouts were estimated to be more than US$ 1 Trillion. One might ask, where does the US Government get all these money from?

The US National Debt

The U.S. National Debt is now well over $10 trillion. This is nearly double the debt in 2000, which was $6 trillion, and $1.3 trillion more than 2 year ago, when the debt was $8.7 trillion.

What's happened in the US? How can the US accumulated such debts? Who have caused all these debts?

The I.O.U.S.A Documentary Film

A documentary film called the I.O.U.S.A, tried to explain all about these US National debts in its 30-minute video shown attached.

Saturday, December 6, 2008

A Nuclear Power Plant Proposal for Singapore

Introduction

Singapore is too small to have a Nuclear Power Plant. “We must have the power plant located at least 30 km away from populated area”, said our Minister Mentor, Mr. Lee Kuan Yew, in a recent presentation on 5 November 2008. This article will introduce a nuclear power plant option that we can use safely in Singapore.

What is this Option?

The mini or miniature nuclear power plant (MNPP) that can be installed underground and underneath each and every HDB block. These MNPPs will not have the Chernobyl effect nor will they require the 30 km clearance rule.

What are these MNPPs ?

The MNPPs are small and self contained nuclear power generating plants that have mini or miniature or even micro reactors. The smallest reactor is about the size of a bath room (about 12 m2) and the largest, about the size of a badminton court (about 50 m2).

They can supply electricity from 200 kw, enough for a HDB block to about 45 MW, enough for 45,000 homes in Ang Mo Kio New Town. Together with other ancillary equipment such as steam turbines and generators, a 50 MW MNPP may need a space as big as a JTC factory or about 1,500 m2.

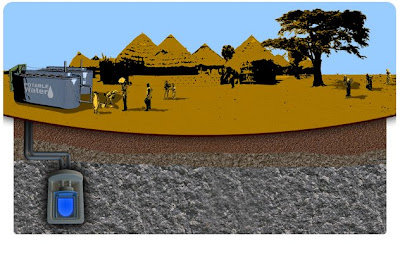

The advantage of MNPP is that the whole plant can be buried underground as shown attached.

The complete reactor unit can be manufactured in a factory, then shipped to site and then returned back to the factory for refueling.

The testing model is said to contain no cooling tower with minimum maintenance requirement. The residual or excess steam can be vented into the outer shell, where it will condense into water that can be collected and recirculated to cool the core. It would use no primary water pumps.

How Long will the Fuel last before next refueling?

Each reactor has a fuel supply for 7 to 10 years. The refueling can be done in the factory. The 200 kw Toshiba unit claimed to have a fuel supply of 40 years for a single block of building.

How Safe are these MNPPs?

According to manufacturer’s claim, the reactor is designed based on a 50-year-old design that has been proven to be safe for the students to use. They expect little objection from the countries to use the MNPPs.

What are the Expected Installation requirement ?

The MNPP can be installed underground and underneath any building.

Depth

The depth at where the reactor to be located will depend on the explosion power of the nuclear reactor. Toshiba recommended the reactor be buried 30 meters under ground in a sealed container so that it would not be easily reached by earth moving equipment.

Encasement

The reactor is expected to be surrounded by strong layers of steel, lead, and concrete in order to protect their operators from excessive radiation levels.

What about cost ?

The Chief Executive of Hyperion, who has about 100 orders, said "Our goal is to generate electricity for US 10 cents a kilowatt-hr anywhere in the world". MNPP will cost approximately US$25m each. For a community with 10,000 households, that is a very affordable US$2,500 per home.

When can we expect to use MNPP?

The MNPP is presently being developed and tested in US and in UK and would become commercially available in year 2015. In UK, Hyperion (Now changed to Gen4Energy) planned to set up three factories to produce 4,000 MNPP between 2013 and 2023. They have a pipeline for 100 MNPPs with a 6-year waiting list.

MNPP Accidents

MNPP was first used in the US in early 50s. Then most MNPP were above ground. In 1961, there was an accident happened in a facility, located at the National Reactor Testing Station approximately forty miles (60 km) west of Idaho Falls, Idaho. 2 people were killed and about 22 people were exposed to some radiations. The MNPP were subsequently buried to contain the damage.

Update: 13 May 2014

There are now 8 suppliers to choose fromhttp://en.wikipedia.org/wiki/Micro_nuclear_reactor

Update: March 2016

1. Development of Samll Modular Reactors

United Kingdom

In 2016 it was reported that the UK Government was assessing sites for deploying SMRs in Wales - including the former Trawsfynydd nuclear power station - and on the site of former nuclear or coal-fired power stations in Northern England. Existing nuclear sites including Bradwell, Hartlepool, Heysham, Oldbury, Sizewell, Sellafield and Wylfa are thought to be possibilities.[9]United States

The Tennessee Valley Authority announced it will be submitting an Early Site Permit Application (ESPA) to the Nuclear Regulatory Commission in May 2016 for potentially siting an SMR at its Clinch River Site in Tennessee. This ESPA would be valid for up to 20 years, and addresses site safety, environmental protection and emergency preparedness associated. TVA has not made a technology selection so this ESPA would be applicable for any of the light-water reactor SMR designs under development in the United States. [10]

The Utah Associated Municipal Power Systems (UAMPS) announced a teaming partnership with Energy Northwest to explore siting a NuScale Power reactor in Idaho, possibly on the Department of Energy's Idaho National Laboratory.[11]

The Galena Nuclear Power Plant in Galena, Alaska was a proposed micro nuclear reactor installation intended to reduce the costs and environmental pollution required to power the town. It was a potential deployment for the Toshiba 4S reactor.

https://en.wikipedia.org/wiki/Small_modular_reactor

2. Toshiba 4S

https://en.wikipedia.org/wiki/Toshiba_4SRelated article

1. Safe, modular, scalable nuclear power generation

2. Clean, Safe, Affordable Power

3. The US's First Nuclear Accident

4. Toshiba's Small Fast Reactor 4S (10 MW)

5. Toshiba Builds 100x Small Micro Nuclear Reactors

6. Nuclear Power Generating in Singapore

Friday, December 5, 2008

How Much Can One Profit From a Recession?

There are fears that market will plunge during a bear market in a recession. But a study has shown that market could rebounce and rise 25% from its low before the recession is officially declared to be over.

The Table

The attached table from a study shows 14 recessions where bear market lasted for 6 to 34 months, the longest being the “Great Depression” in 1929. The table shows the following:

a) An average return of 8.7%, if one were to stay invested throughout the recession periods;

b) A profit as high as 25% if one were to invest during the lows and take profit by the time the recession is declared over.

The table also shows that not all the recessions have noticeable bear markets and also, 8 out of 11 recessions have created another new bull market when the recession is over.

One can compare the performance of various recession by following this link.

Disclaimer:

Information here is for sharing and learning. It is not intended to give any advice on any stock or movement or trend of any index. If a price or movment of a stock/index is given, it is only intended for illustration. The reader shall verify the information given here before using them.

Wednesday, December 3, 2008

Today and Yesterday's Bear Market

The present bear market appears to track the 1942 or the 1973/74 bear market except the momentum is quite similar to the 1942 than 1973/74 bear market. It is hopeful that we are tracking the 73/74 market or 1st part of 1932 as we have the second World War in the 1942 market.

The comparison chart can be viewed by clicking the following picture.

If one cannot get the interactive features of selecting and comparing the graph, one will have to download the latest version of flash player here.

Disclaimer:

Information here is for sharing and learning. It is not intended to give any advice on any stock or movement or trend of any index. If a price or movment of a stock/index is given, it is only intended for illustration. The reader shall verify the information given here before using them.

Monday, December 1, 2008

Why STI is Down Today?

Introduction

Why STI is down when DOW and the US markets were up last Friday? This article will try to explain using very simple technical tools called simple moving average curves.

Why is Simple Moving Average ?

A Simple moving average is just an average value of a stock price, or indicator, averaging over a period of time. The term "moving" implies the average value will change or move. As the stock's price changes over time, its average price moves up or down.

Where Can I Watch Simple Moving Average Curve?

One can watch it from the any technical analysis software or free from Yahoo website. The latter only give Daily chart. Some private website, such as Shareinvestor.com , can provide intraday charts, such as 60-minute chart for a fee.

How Can I use Simple Moving Average Curves?

Most common curves being used are 200-day(200), 50-day(50) and 20-day (20) moving average(MA). The 5-day MA and 10-day MA are often used by Day Traders for day to day tradings. Among the curves, the 20 MA is most commonly used. It acts like a magnet that stock prices or indexes will always fall back after wondering away.

The MA curves are actually the supports as well as resistances of a stock price or index. For example, the 60-minute chart attached shows that STI has crossed over the 20 MA (green) and 50 MA(blue) and these lines becomes the support lines. STI is now testing the 200 MA (red) line, which is now the resistance line.

Apparently, STI just failed in the morning to break the 200 MA resistance line and index started to fall. It will fall towards the 50MA or 20 MA and wait. However from the chart, one can see that this is the 3rd time STI is testing the 200 MA line. It is always said that as more times a resistance or support is tested, it will break eventually. The rising 20 MA and 50 MA are at present supporting this action to break the 200 MA line.

Doubleclick for larger view

What Would Happened if STI Breaks the 200 MA?

200 MA is usually taken as an important support or resistance line as it always indicate the health of the index or stock price going ahead. If the 200 MA is broken, it would then become the support that will bring STI to new highs; otherwise, it would just remain as a resistance.

Can We See What Happened in the Daily Chart?

The 200 MA may reflect in the Daily Chart as an important support or resistance event. In this case as shown in the daily chart attached, STI is about to cross the 20-day MA (green). If the resistance of the 200 MA in the 60-minute chart is broken, it would mean that STI would be able to break the 20-day MA resistance in time to come.

The side-way movement of the 20-day MA in the Daily Chart indicates that STI has begun its recovery process. If the 20-day MA resistance is broken, STI would want to head for the next resistance, which will be the 50-day moving average. On the other hand, it might reverse to go down to meet the lower trendline of the triangle that had been enclosing it since Oct. STI will want to seek lower lows, lower than 1,600 if the lower trendline is broken.

Disclaimer:

Information here is for sharing and learning. It is not intended to give any advice on any stock or movement or trend of any index. If a price or movment of a stock/index is given, it is only intended for illustration. The reader shall verify the information given here before using them.

Simple and Easy Way To Backup Photos, Movies and Documents from handphones

2 December 2023 In the past, we used iTunes when we wanted to transfer or backup our photos, movies, and documents from iPhones or Androi...

-

28 July 2023 For the last 2 trading days, SembCorp’s price has tried hard to recover from its recent fall caused by the termination of Semb...

-

21 July 2023 Today, Keppel Corp’s trading price dropped from S$6.96 to S$6.79. This is a loss of S$0.17 or 2.44% from Thursday's clos...

-

16 July 2023 In the last post on 8 July 2023, we said that the SIA price was forming another Flag. This Flag2 has now been completed as...