1st August 2018

NASDAQ fell about 4% after reaching its all time high of 7,932 on 25 July 2018. It may appear to many that this is just another rotational play where investors are selling away winning stocks and shifting their money from one segment of the market to another especially when NASDAQ has just reached its all time high. There is nothing to worry about.

What’s Behind NASDAQ’s Drastic Sell Off?

There are many reasons. One of the reason is that the US investors were going more for “growth” stocks which are subjected more to speculation as they are often “fueled” by news of future earnings or growth. The US investors has shifted their portfolios more to buying "growth" stocks rather than "value" stocks.

What is Growth and Value Stocks ?

Growth and Value are two fundamental approaches in stock investing. Growth investors will buy companies or Growth stocks that offer strong earnings growth while Value investors will seek undervalued stocks or Value stocks that has good fundamentals.

How to know there is a Shift?

The shift can be seen from the following chart that compares the trend of S&P 500 Growth ETF( IVW) and the S&P 500 Value ETF (IVE). The chart clearly shows that investors shifted from Value stocks to Growth stock after mid 2015. The shift is more pronounce in the last leg between 2017 and 2018.

This shift has unfortunately created a market that is extremely sensitive to news and prepared to respond rapidly. When growth-stock investors become disappointed with a company, they would dump the company's stock and proceed to buy the next exciting company.

On July 29, 2018, almost all the growth stocks like Facebook, Apple, Amazon, Netflix, Google and Alphabet in NASDAQ and S&P that have been sold off .

Are There Any Sign?

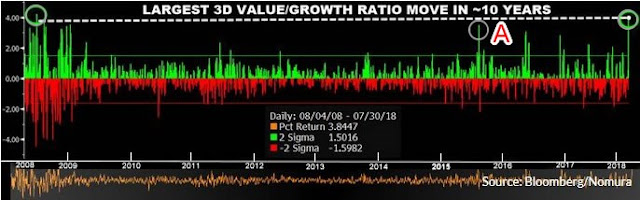

Analysts who tracked closely the “Value/Growth” ratio of the US market are showing us the following chart

The chart plotted the value/growth ratio of the US market in the last 10 years between 2008 and 2018. It shows that the growth/value ratio, last peaked around mid 2008, peaked again recently with investors buying 4 times as much “growth” stocks than the “value” stocks. A "near peak" occurred around mid 2015 (Point A above)

Do We Need to Worry?

It is quite common to see market selling off especially when NASDAQ has just retreated from its recently peak. It is also common to see investors adjusting their portfolios, rotating between one segment of the market to the next segment.

However, if we examine the above Growth/Value chart closely and compare the happenings to the DOW chart, we can see that the peaks or near peaks of value/growth ratio occurred around the time when market took the plunge as shown in the following chart.

What the Market Was Telling Us?

On July 26, 2018, Facebook had the biggest single day loss of about USD$120 billions in US history. Mark Zuckerberg lost more than USD$16 billion as a result.

S&P’s market cap shaved off around USD$2 Trillion since all time high in 2018.

The 5 big companies lost a total of USD$330 billions altogether since their highs.

from

CNBC.

In Conclusion

While it all appears fine with markets started to stabilise and even recovered some of its losses, we mustn’t be too complacent with the market because

1. The investors have shifted from value stock to growth stock since mid 2015. This is especially so, after Trump was elected to office in Jan 2007. Unfortunately, this shift has increased the risk of a market plunge as growth stocks are often fueled by speculation of future earnings and growth;

2. Studies showed that the Grow/Value Ratio has again reached another peak since the last market plunge in 2008 about 10 years ago;

3.

The market experienced tremendous price shock on July 26, 2018. It resulted big investors having to lose a lot of fund and money.

It is not known how well

they

could handle this market shock.

Disclaimer: This article is for information and educational purposes. Readers are advised to conduct their own research and study to make their own investment decisions.

Referencestinyrul : https://tinyurl.com/ycfewutf