27 Dec 2018

Tinyurl : https://tinyurl.com/ydbgtrxy

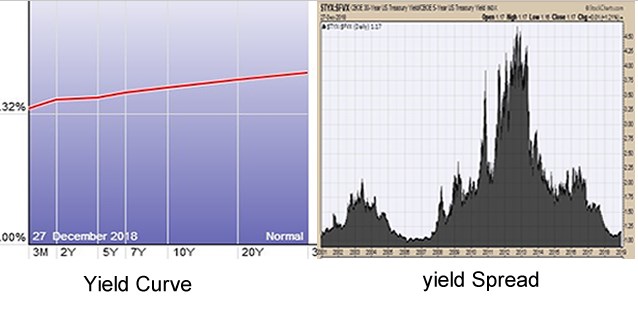

It is a common knowledge that investors are using yield curve to predict the health of economy. If there is a recession coming, one would expect yield curve to be flattened. One reason is that the market is expecting Fed to raise its Fed rate in near term. This will push the short term bond yield up and flatten the yield curve.

Yield Spread and Yield Curve

Yield Spread Curve and Yield Curve are different. Yield curve shows the yields of various type of bonds in a single day whereas the Yield Spread Curve shows 2 type of yields over a period as illustrated in the following pictures.

A yield spread curve is more useful as it can show not only the flattening yield; but also, it can show when that happened and how long flattening yield had lasted.

The Yield Spread Curve

In the 2008 recession, the 30:5 year yield spread curve flattened around Mar 2006 when the yield spread was at its lowest level. But the stock market did not crash until Oct 2007 which is 1.5 years later. In 2000, the yield spread curve took the same beating with its lowest level around May 2000. This one took less than 6 months to see the market crash.

What is Common About the Market Crashes?

Besides the flattening yield curve, there is one thing in common. The yield spread curve always rises as soon as the stock market started to crash. This means that if there is a stock market crash, there is an increasing interest for investors to safe park their money in short-term bonds rather than in the long-term bonds.

Why is this so?

There isn’t much explanation one can found in the Web except this article written by Beth Braverman in CNBC.com. He explained that

- The returns of short-term bond fund is more stable in rising interest rates and inflation environment;

- Short-term strategies has lower annualised volatility, less than stocks and long-term strategies;

- Investors can cash back their money in a shorter time frame.

This make sense because if one expect the stock market crash to last only 1 to 2 years, why lock their money in the long-term bonds which has higher risk and volatility? Moreover, Fed is likely to cut the short-term rate during a recession and this will push up the short term bond prices.

How’s the Present Yield Curve?

The present yield spread curve looks very much like the 1999-2000 yield spread curve. It is rising fast and appears to have a short flattening period.

There are 2 observations

1. The yield spread curve in 2008-2013 period rose to a peak of about 4.5%, more than twice the level in 2003. This is probably caused by the 3 QEs that were introduced between the period from Nov 25 08 to 2013.

2. The yield spread curve rose slightly recently from 1% in July 2018 to about 1.7% in Dec 2018.

What is there to learn?

It is quite clear that the investors were trying to park their money recently in the short-term bonds. The more the money is parked in short-term bond, the faster will stock market collapse under such movements.

What to do next?

Observe carefully how the yield spread curve develops through this link. Dump and run away from the stock market if the yield spread curve continue to rise higher and higher. It is signalling to us that more investors are drawing out their money from stock market to park their money in short-term bonds.

Disclaimer: This article is for information and educational purposes. Readers are advised to conduct their own research and study to make their own investment decisions.

Tinyurl : https://tinyurl.com/ydbgtrxy