27 January 2019 (Update)

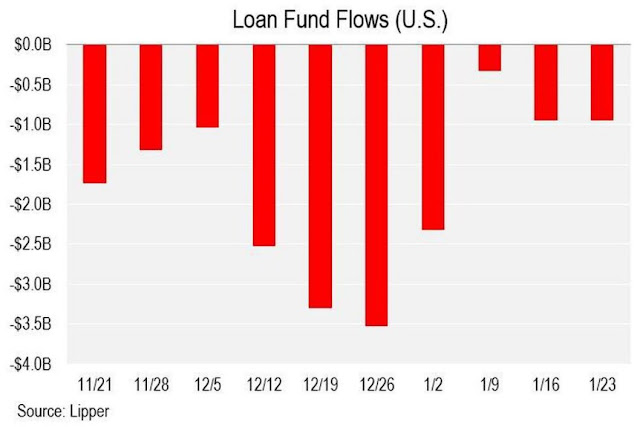

The leverage loan funds continued to bleed in January 2019 after massive loan fund withdrawal at the end of 2018 although the amount of withdrawals were much lower as shown in the following chart.

31 December 2018

The leverage loan funds continued to bleed in January 2019 after massive loan fund withdrawal at the end of 2018 although the amount of withdrawals were much lower as shown in the following chart.

31 December 2018

https://tinyurl.com/ybbyx3gn

What is a Leverage Loan ?

In layman’s language, it is a loan extended to Corporations who cannot get proper loans from the banks because they have either bad debts or credit history. It is a high risk loan that can easily be defaulted and therefore, lenders always demand a higher interest rate or the loan is leveraged. In US, this is a US$1.3 Trillions business which has doubled in the last 5 years.

How Different from Margin Loan?

Margin Loan is also a kind of leveraged loan but it is provided by stock brokers for buying of equity and stock. It is heavily regulated by the Authorities. Leverage loan is a presently a private arrangement between the lender and the borrower on agreed terms which are loosely regulated by the Authorities under the “2013 Leveraged Lending Guidance”. Understand that the authorities were prepared not to enforce the lending guideline due to pressure of deregulation.

What about Subprime Loans?

Subprime loans are often refer to loans provided to home owners who have low or poor credit scores. It is also often packaged as "Mortgae-backed Securities (MBS)” and sold to the public. It was very popular in 2008, leading to the 2008 credit crisis. Now some banks or its subsidiaries are providing similar structured loans but for the Corporations with high debts or poor credit ratings.

What is the Present Situation?

The total leverage loan in the US has grown to US$1.3 Trillions, much higher than high yield bond market. The leverage of such leveraged loans has climbed to more than 6.5 times in the US.

In Asia, it is about 4.5 to 5.5 times. The leveraged loans are climbing back to the level seen in 2006/2007 in Europe and in the US as shown in the following chart.

In Asia, it is about 4.5 to 5.5 times. The leveraged loans are climbing back to the level seen in 2006/2007 in Europe and in the US as shown in the following chart.

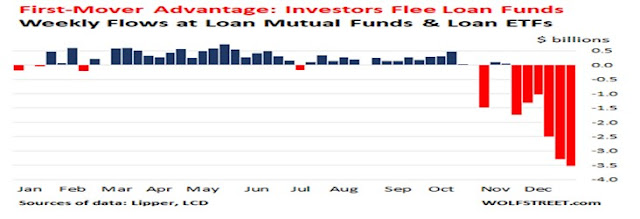

Like Margin Loans, Leverage Loans are also sensitive to the changes in the market. In October 2018, the lenders first seen the returns of leveraged loans declined to negative in the secondary markets.. This could have signaled troubles ahead in the market, causing panic withdrawal of money from Mutual Funds & Loan ETFs in November/December as shown below.

More than US$10 billions of fund were withdrew from the market in the 2 months. This is almost the whole borrowings of 2018.

Why Leverage Loan Crisis can be Next Market Crisis?

On the record, the US's leverage loan is only US$1.3 Trillion in total but there was report that the Corporations have actually owned exorbitant debt to a tune of about US$2.5 Trillions. This amount is coming close to the $3 Trillion debt that the Subprime Mortgage market peaked and collapsed in 2008. Just like the subprime mortgage market, these leveraged loans have been packaged as “collateralized loan obligations (CLO)” and sold to “yield-hungry” investors. Because of this, many articles have been written about the possibilities of leveraged loans being the next “catalyst” for the coming market crash.

Can Fed come to the Rescue Again with QE4?

Ms Yellen, the last Fed Chairperson and IMF’s Christine Lagarde warned about the rampage of Leveraged Loans recently. Fed also reviewed the “2013 Leveraged Lending Guidance” in May 2018. Unfortunately, these efforts did not help to "quench the thirst” of the market. The Leverage Loans continues to climb.

However, it is expected that Fed would not sit around looking helpless this time if there is a similar crisis. It could have already prepared itself for QE4 to be implemented and ready to “print” money except this time, instead of buying the “Mortgage-backed Securities (MBS)”, it could be buying or swapping the “Collateralized Loan Obligations (CLO)” from the Banks, Institution and the big Fund players. The buying of CLO may be more complex than MBS because the Corporations' assets are not as transparent and simple to deal as home ownership. Anyway, it would appear that Fed’s “balance sheet unwinding” exercise would "die of premature death", paving way for a more serious credit crisis to come in the future.

Disclaimer: This article is for information and educational purposes. Readers are advised to conduct their own research and study to make their own investment decisions.

References