Search This Blog

Thursday, June 23, 2022

Would Investors Ditch the US Bond Market?

Friday, June 10, 2022

Useful StockTrading Patterns Occurring Recently

Jump to

1) Bear Flag in DOW (22 February 2022)

Update: 25 February 2022

Update: 1 May 2022

2) Top Island Reversal (Singapore Airline)3) Symmetrical Triangles (HSI, SSEC, Crude Oil)

Update: 9 March 2022

Update 26 April 2022 (SSEC)

Update 10 May 2022 (DOW)

Update 24 May 2022 (DOW)

# Bear flag; trading pattern, how to trade, market rise, fall

There are lots of articles written about this topic. Most of them are just descriptive although some come with graphs and charts. There are quite difficult for laymen to understand. This article will intend to make this learning as simple as possible. It will use animated charts where possible to illustrate; at the same, it will chart the stock direction using the present market prices.

1) Bear Flag in DOW (22 February 2022)

The first pattern that appears today is a bear flag as shown.

This chart pattern appears frequently whenever there are serious corrections where the market falls more than 5% from its peaks. In the recent market correction, DOW fell by about 6% from its all-time peak of about 37,000. It then recovered about 3% just to see another fall of 4% to the present position of 33,500. This time, it made a "bear flag pattern" as shown above.

How Easy to Spot & How to Trade?

The bear flag pattern is easy to spot and trade. One could usually tell where the price will go and what will be the target price. In this case, the first target price is around 32,000 as shown in the following animated chart

How will it go down?

Stock will not fall in a straight line unless there is sudden bad news spreading such as the sudden and unexpected failure of a financial institution or the breakout of war; otherwise, the market will always want to test and challenge the price falls. When this happens, the stock price will want to test whether it will climb back & cross the lower trendline of the flag as shown red in the following chart:

Recently, we have had the Ukraine crisis that sparked the market price correction. But this war between Russia and Ukraine has not developed into war yet. There is a pretty good chance that the market will want to test and challenge the price falls.

back to top

Update: 25 February 2022

As expected, the market fell last night to touch the target price of about 32,300 last night briefly. However, Ukraine and other crises are still very real out there. It is expected that the market will revisit the lows again.

back to top

Update: 1 May 2022

DOW formed another bear flag in March. It could have recovered if it could stay above the red trend line as shown in the chart below. It struggled and made several attempts but failed so far which made it more vulnerable. One would expect DOW to break its support @ 32,600 soon to make another new low.

2) Top Island Reversal

A top island reversal pattern was spotted for Singapore Airlines. It is a blue-chip company in Singapore Stock Exchange (SGX). The pattern has shown up in the daily chart as well as in the 4-hour chart as shown below.

How To Identify?

It can be identified by the island it has formed. Usually, when the price gaps up, there is always a rise in the trading volume, though in this case, the rise is not significant as shown in the following chart.

For those who are looking to short Singapore Airlines, it is the best time to do so when the price breakaway from the island. One should place a stopgap price at the breakaway point of the last candlestick.

For those who are looking for an opportunity to enter the market again, one will have to look for a bottom reversal pattern. This is usually shown up in either an exhaustion candlestick (as shown above) or an exhaustion gap candlestick with a significant increase in volume. It can be also in any other reversal pattern.

Update: 9 March 2022

SIA failed to keep its momentum because the Ukraine war spiked oil price hikes recently. Oil prices went up by 35% in a short span of about 2 weeks. It could cost aero fuel to go up in price. The SIA stock price fell immediately until it hit another exhaustion candlestick yesterday. If there is no further hike in fuel oil pricing, SIA might recover from here. Whether it will "leap & bound" to a much higher level will depend on the future oil prices.

3) Symmetrical Triangles

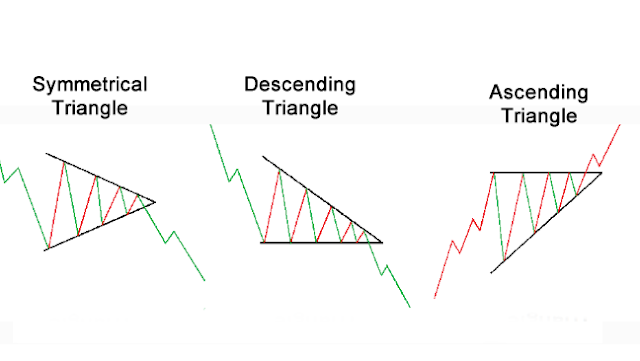

The Symmetrical Triangle is an interesting pattern that is often seen in stock trading. One can easily draw such a pattern by linking the peaks with a trendline and the troughs with another trendline. The following picture shows 3 types of Triangle patterns: the Symmetrical, the Descending and the Ascending Triangles

The above example can also be used for the top break-away symmetrical triangle patterns or other similar kinds of patterns. Usually, when there is a break-way from the triangles, there should be an increase in trading volume.

4) Head and shoulder pattern

Head and shoulder is another interesting pattern that is often found in stock and indexes during the bear market or when the stock or market price has been “pushed” artificially above the unsustainable price limit.

Characteristic

The pattern consists of left and right shoulders, a head & a neckline. A typical pattern is shown as follows. The neckline need not always be in the horizontal position. The neckline often appears as a rising trend line

Example?

This Head and Shoulder Pattern was recently found in the Shanghai Composite Index as shown. Ir could be found also other China markets like the Shenzhen Index although the pattern could be slightly different.

What to expect?

One would expect the stock or market price to pick up steam in the beginning with market players all rushing in to take a position, waiting for the price to rise. As soon as the price has been “pushed” to the peak, the market players will expect a correction to follow. They would stop buying. However, when they see the market isn’t correcting as much as they have expected, they started the buying spree again. This buying will push the price to form the right shoulder By now, most of the market players remain a "waiting and see" attitude and would start selling if there is unfavourable news emerging. If there are lots of them dumping, the market volume will increase; if not, the market will retest the low and challenge the broken neckline as shown in the case of the Shanghai chart.

What is the Target Price?

In the case of head and shoulder patterns, the target price is usually projected from the neckline's break-point as shown in the above picture. That line used for projection is drawn connecting the highest peak in the "head portion" to the neck-line as shown. In this case, the target price is around 3,050.

back to top

Earlier when DOW formed a bear flag, we expected DOW to test 32,360 as shown here. Since then, DOW recovered but it made a dead cat bounce to come back and test this support again last night. Except this time, it has broken the 32,360 support with a fresh Head and Shoulder pattern as shown attached, it is likely therefore for DOW to test the support of 31,250 (marked 2), failing which, it will test 30,250 (marked 3) & might go down further to test other supports.

back to top

Update 24 May 2022

Dow made more head and shoulder (H&S) pattern as it went down. It has test 31,250 recently and retraced back as shown. It is now testing the H&S pattern. If it fails to overcome the resistance at the H&S, it will want to sink again to test 30,250 or the other lower supports.

Update 12 June 2022

On its way down, DOW made another H&S pattern as shown. This pattern appears to be quite reliable as its H&S resistance has been tested & challenged before going down.

The next target is likely to be below 30,000 as indicated\

5) Candlestick Gap Covering

Candlestick gaps are often created when there are announcements of special trading news that might affect the stock prices; for example, the recent news about the US's inflation hit 8.6%, causing the market to create a candlestick gap last Friday, 10 June 2022. Another candlestick gap was created the next trading day on Monday, 13 June 2022 as there were fears about markets falling into the Bear territory.

There are about 4 types of gaps found in trading charts; namely, the breakaway gap, the exhaustion gap, the common gaps and lastly, the continuation gap as described in this webpage.

As the recent two candlestick gaps are caused by fears, they might be covered up soon when the fears go away or the events are overtaken by other events.

Update 23 June 2022 - Deciding DirectionIn view of the above, it is likely that DOW would want to continue going ahead to cover the other gaps ("gap 2"). It would also try to break the declining trendline; failing which, it would back down to cover the "gap 3" as shown.

That piece of bad news sent DOW tumbling down over 700 points. DOW ended with an index of 30,950 or a loss of about 500 points for the day.

One can see from the above 2 charts that the US stock market is very sensitive to job reports and CPI numbers in recent months.

In the past business cycles, the stock prices tend to rise after the fall of Commodity and the rise in US Bond markets.

6) Support and Resistance

Disclaimer: This article is for information and educational purposes. Readers are advised to conduct their own research and study to make their own investment decisions.

How To Improve WiFi Reception

There are many ways one can improve the WiFi reception at home. But before one jumps to do any physical changes to WiFi systems, including ...

-

1. How Air-conditioning works? 2. The Special Tools and Equipment? 3. The Professional Must Owned Equipment? 4. The Professionals Verse ...

-

There are many ways one can improve the WiFi reception at home. But before one jumps to do any physical changes to WiFi systems, including ...

-

9 April 2018 1) The Hard Wiring Connection 2) Blue Tooth Connection 3) More about SPDIF and HDMI (ARC) 4) Why HDMI (ARC) Not Working Xiao...