21 July 2023

Today, Keppel Corp’s trading price dropped from S$6.96 to S$6.79. This is a loss of S$0.17 or 2.44% from Thursday's closing price. It is the largest price drop in 2 weeks since 6 July.

The news today about the Keppel Fund has acquired a building in Seoul for an undisclosed sum must have been responsible for the drop in today's price.

About the Acquisition

With this latest acquisition, Keppel claimed to have about 1.4 trillion Korean won ($1.5 billion) worth of deals in South Korea since 2021. The total assets in South Korea under its management (which includes the Samhwan Building and waste management company, Eco Management Korea Holdings) are now about 2.6 trillion Korean won or S$ 2.6 billion.

According to Google Search, Keppel Corp has made the following deals since 2021

a) The acquisition of Samhwan Building

This building was acquired in 2022 for a sum of about KRW220 billion ($228.7 million). It is located in the Jongno central business district in Seoul. It is a 15-story building that has a total gross floor area of 31,403 square meters.

b) The acquisition of Waste Management Company

c) The acquisition of the Sheraton Seoul D Cube

Therefore, one can

roughly estimate that the Sogong Annex could have cost Keppel around S$480 million (S$1.5 billion - S$230 million - S$666 million - S$120 million) unless there are other acquisitions not found by googling.

Unit Cost of the Acquisition

If S$480 million and the gross floor area is 15,750 sq meters, the unit cost per sq meter for this acquisition will be S$30,000 per sq meter. This will be the most expensive building Keppel has purchased so far in Seoul.

In comparison, this building is more expensive than Singapore's Shenton House in CBD which has a unit cost of about S$13,000 per sq meter, In the details of a recent collective sale, the reserved price put up was S$600 million. The Shenton House building has a gross floor area of 48,000 sq meters.

However, we could not use this Singapore's unit measurement to judge if the unit price of Keppel's latest acquisition is expensive. We will explain more when we talk about the "takeaway".

The Locations of Buildings

The exact location of the Sogong Annex and Samhwan Building

is shown in this Google map. Songang

Annex is right in the center of the CBD area and very close to the Seoul Tower.

It must be in the very prime area which demanded a higher unit price.

Why the Price Drop?

As the actual acquisition price of the building was undisclosed and most were not familiar with the property prices in South Korea to assess if the purchase price was fair and reasonable, many traders must have been working on the “sell first, talk later” mode to protect their capital.

Technical Analysis

The following chart shows that Keppel Price has almost broken the trendline T2 and was up and running to scale higher high until this news about the acquisition of the Seoul facility broke up on 21 July 2023. The news sent the Keppel price below Trendline T2 and is now preparing to test Trendline T1 again after bouncing from it on 7 July.

Going forward, we are expecting Keppel Price to test the support at S1 first. If S1 failed to hold, it will want to test again the support at T1.

The Takeaway

a) Price of Acquisition

The acquisition may be a bit frightening at first sight, especially when the price was undisclosed. The information was not properly and clearly

articulated as to how such an acquisition could have affected Keppel’s future business.

There must be good reasons why Keppel decided to buy the Sogong Annex although it is much more expensive than the price of Samhwan Building which it acquired in December 2022. This is because the location of Sogong Annex is in a very prime area. It is just about 1.3 km from the Seoul Tower.

According to this Korean economic news, office building prices in downtown Seoul set a fresh record high in 2021. The highest unit price at that time surpassed KRW 40 million per one pyeong or 3.3 square meters. This is around S$120,000 per sq meter. This price is almost 4 times more than the S$30,000 per sq meter paid by Keppel for the Sogong Annex building as shown in the following table

b) The Assets under Management (AUM)

Presently, Keppel’s

business is spreading across 6 areas of the Globe as can be seen from the

following photo extracted from Keppel’s 2022 annual report

It can be readily deduced that these assets under management (AUM) in South Korea are just a small part that contributed very little towards the revenue of $6.6 billion in 2022. The biggest part of more than 80% comes from businesses in Singapore. Moreover, Keppel Capital presently has S$50 billion of Assets under its management (AUM) and they are working toward a target of S$200 billion of AUM. The S$480 million for this acquisition of Sogong Annex is less than 1.0% of the S$50 billion of AUM.

c) The Office Rental Price in Seoul

Although the housing market in South Korea was not as rosy as before and the price of housing properties has dropped since 2022, there are reports that the price had stabilized in June as buying of properties in Seoul improved.

As for the office rentals, the latest report from Cushman & Wakefield said that the good office space vacancy in Q2 remained steady at 2.6% and the average monthly rental continued to rise at a rate of 1.2% YOY and 8.4% QOQ.

Disclaimer: This article is for information and educational purposes. Readers are advised to conduct their own research and study to make their own investment decisions.

9 July 2023

In the article dated 5 July, we wrote about Keppel’s price being trapped in a rising expanding bearish wedge as shown in this weekly chart.

Since then, the price has been further developed when we revisited it on 7 July.

We can see from the newer chart that Keppel’s price is about the test the trendline support T3 very soon. If it can bounce from this trendline support T3, Keppel's price can be very bullish.

On the other hand, if the price took a turn for the worst for some unknown reasons, and the prices were to break the trendline support T3, things could turn ugly. Trading after that can be very volatile especially when the trading volume is large at a time when it breaks the trendline. This is because the trendline T3 is one very strong support. It is a Head and Shoulder line. When that happened, we would expect Keppel's price wanting to go lower lows.

In the daily chart as shown below, we saw the price has broken the orange T2 trendline. It has turned trading sentiment bearish and traders are expected to bring the price down to test the strong Trendline T3 as discussed earlier.

Going forward, we hope Keppel's price can bounce after hitting the trendline support T3. This is because many broker houses have higher targets. In addition, Keppel has signed recently to work together with Petronas Malaysia's Gentari to develop renewable energy projects. Presently, Malaysia has an ambitious renewable energy target, aiming to reach 70% of renewables in the power mix by 2050. This target is slightly bigger than the target set by Indonesia which is 2/3 power mix by 2050.

5 July 2023

Keppel Corporation Limited (SGX: BN4), in short, KepCorp, is one of the pioneer companies in the SGX exchange. It was incorporated on 03 Aug 1968 and listed in SGX on 24 October 1980. The group was originally in the offshore and marine engineering and construction services. It has now expanded to become a global investment holding and management company and the operator of infrastructure, power stations, district cooling, and other business like real estate in Singapore as well as in many other countries like China and Malaysia.

Present Price Trend

KepCorp has a bullish trend at the moment. This weekly chart shows that It has broken the red trendline in early 2022. This red trendline has been trapping KepCorp's price movement for the last 8 years since 2014. KepCorp's price is now moving in an uprising and expanding wedge, enclosing by trendline T2 and T3 as shown.

(Note: Corrected using adjusted price. The original chart using investing.com was not adjusted for distribution in Specie of Sembcorp Marine share)

StockTarget Date

KepCorp is presently trading in SGX for about S$6.60 per share. The target price of most broker houses and analysts is in the range of S$7 to S$9 as shown in this sgInvestor picture.

Present Stock Movement

KepCorp's price is presently trapped in an up-rising channel as shown in the following daily chart. It has a resistance (R1) at S$7.11 and a supporting price (S1) at S$ 6.53. We expect YZJ will move within the channel marked as T1 and T2. If KepCorp's price can break T1, we should see higher high prices; otherwise, we should expect the price to move lower.

For information, we have also found an additional trendline that might show how the price will move in the shorter term. This trendline, marked in orange, will guide the price movement in the meantime. If the price were to break below this orange trendline, we should expect KepCorp to test the support at S$ 6.23 (S2)

The Candlestick Gap

Stock Market Performance

KepCorp's stock price was not performing as well as its peers like SembCorp industries. This can be seen from how the price recovered after the recent fall caused by EMA's temporary price cap announcement.

SembCorp Industries's price has almost recovered whereas KepCop's price is still hovering below. This is despite the broker houses and Analysts having given equal ratings as they gave the same to SembCorp.

The main reason could be that KepCorp was more exposed to China. As a result, it has reported a deeper-than-expected drop in net profit for the year 2022. Its net profit dropped to S$927 million ($709.91 million) for the year ended Dec. 31, from S$1.02 billion a year ago. But its 1Q 2023 quarterly result was better than expected prompting many analysts to upgrade their ratings.

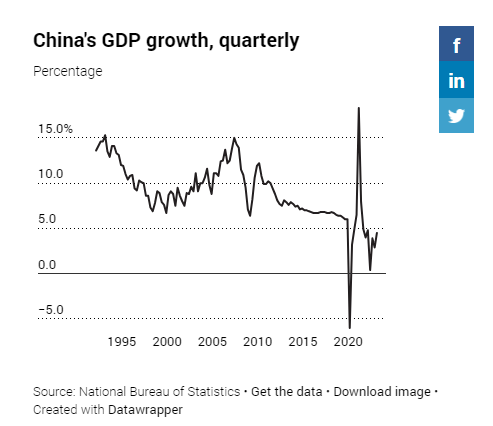

The market traders, however, have different views especially after it was reported that China's economic recovery rate was not as good as expected.

Hence, Going forward, we do not expect KepCorp's prices to leap and bounce like SembCorp did unless KepCorp can reduce its exposure in China or China has improved its economic outlook in the coming months.

Disclaimer: This article is for information and educational purposes. Readers are advised to conduct their own research and study to make their own investment decisions.