26 July 2018

Many investors are watching the yield curves of US Treasury carefully. The trend is worrying as the yield curve has flattened over the recent months, approaching the triggering point where another economy recession is in the making.

What is Yield Curves?

Simply, it is a line that plots the interest rates (which is also the “Yield” when it is referred to Bonds or Treasury Notes). When interest rate rises, so will the yield of the Treasure Bonds or Notes. Normally, the yield is lower for the shorter maturity bonds or notes and higher for longer maturity type.

More about yield curve in here

Why Worry About Yield Curve?

Government Treasury Bonds or Notes are known to be investment safe heavens because they are “backed” by the Government. During good times, investors will buy and keep Bonds especially those with longer maturity such as the 30-year bonds because they are cheaper and have higher yields. During bad times, investors will get worried about the economy. They will sell away their Bonds or Notes even those with shorter maturity such as the 2-year or 10-year Notes. As a result, the yields of those with shorter maturity will rise. The yield curve will gradually flattened and eventually, inverted if the economy is getting worse. Yield curves are often used to predict the condition of an economy.

Present Yield Curve

The present yield curve has been gradually flattened since Trump took office from end 2016. During this period, Federal Interest Rate rose from 5 times from 0.75% to now 2.0 %.

Should the rate continue to rise, one would expect the yield curve to be flattened further.

Trump Worried About Fed Rate Hikes

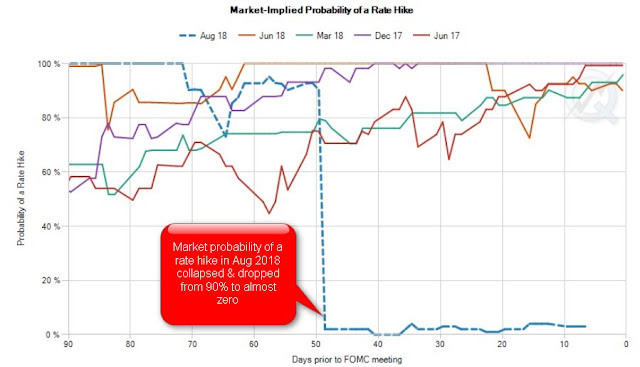

Trump openly expressed concerns about the Federal Rate Hikes recently as Fed mentioned that there would be 2 more rate hikes before the end of the year.

As a result, the implied probability of the rate hike in Aug 2018 collapsed and dropped from over 90% to almost nothing. DOW celebrated the last 3 days with a rebounce of over 300 points.

Why Fed Has to Hike Rates and Unwind its Balance Sheet

1. Fed hike rates because it sees the US inflation rates have been rising over the last 12 months from 1.7% in Jan 2017 to almost 3% in Jun 2018;

2. Fed also sees the market is flooded with liquidity and this caused market growth to almost stagnant with Long Term Corporate Debt rising almost 50% since they introduced QE; meaning, more and more companies are borrowing money to finance their business with little or no future growth registered. Fed has to reduce the risk and pull out the liquidity by shrinking its balance sheet.

Going Ahead

1. Where are we?

This 30-year to 10-year yield index clearly shows that the market is ready to approach the phase that will trigger another economy recession;

2. Will US be able to arrest the problems and reverse the situation?

Fed and the Authority including Trump are obviously aware of the economy slow down and do what they can to arrest the problem. They cut tax and introduce Job Acts which are expected to add another USD 1.5 Trillion to the present debt of more than USD 21.0 Trillions.

The tax cut and Job Acts are able to help the economy but it is unlikely to change significantly the fundamental conditions of the present US economy which is fueled by debts.

A Trade War was also planned to boost the US's export and reduce the US's deficit so as to arrest the rising debts; however, many Analysts are skeptical about the result and some said the US economy might not survive the trade war. This is because imposing tariff in a trade war is equivalent to raising taxes on the goods.

Unless there is a change fundamentally to improve the economy, it is unlikely that above measures will arrest the problems and save the economy.

Unless there is a change fundamentally to improve the economy, it is unlikely that above measures will arrest the problems and save the economy.

Can the US economy survive a trade war? from CNBC.

In Conclusion

We are now approaching the "Valley of Death".Disclaimer: This article is for information and educational purposes. Readers are advised to conduct their own research and study to make their own investment decisions.

Reference

Other Relevant Sites

tinyurl : https://tinyurl.com/yb353k9x

No comments:

Post a Comment