28 March 2019 Update

https://tinyurl.com/y3q9vznj

The PUB's Tender Price for Singapore's second desalination plant at Tuas closed on 23 October 2010.

Altogether 8 tenderers responded to the PUB's tender. Hyflux tendered a price of S$ 0.45 per m3 for the 1st year based on 320,000 m³/d of water supply over a 25-year period from 2013 to 2038. Its tender price is followed by Keppel Seghers/Beijing Enterprises Water Group at S$0.67 per m3 which is about 50% higher than Hyflux's tender price.

The tender price for the rest of the 6 tenderers are enclosed here for information

24 February 2019 Update

Hyflux has obtained court's approval to hold scheme meetings for creditors to vote on April 5. First with the senior unsecured creditors which will include the banks and medium-term noteholders; thereafter, with the subordinated debt holders that will involve the 34,000 perpetual security and preference share investors. Trade creditors of the three subsidiaries will have their scheme meeting on Apr 8.

There were active discussions in the market. Some appealed to the Government for financial assistance; others wanted the Government to intervene in Hyflux's restructuring process. Some called to boycott the coming scheme meetings; others appealed to investors to vote "No to Salim" as shown in this video.

https://tinyurl.com/y3q9vznj

The PUB's Tender Price for Singapore's second desalination plant at Tuas closed on 23 October 2010.

Altogether 8 tenderers responded to the PUB's tender. Hyflux tendered a price of S$ 0.45 per m3 for the 1st year based on 320,000 m³/d of water supply over a 25-year period from 2013 to 2038. Its tender price is followed by Keppel Seghers/Beijing Enterprises Water Group at S$0.67 per m3 which is about 50% higher than Hyflux's tender price.

The tender price for the rest of the 6 tenderers are enclosed here for information

PUB Tender for Singapore's 2nd Desalination Plant | |||

Tender closed on 23 Octobe 2010 | |||

Name of the Company | Tender Price for 1st year | % from lowest tender | |

(S$/m3) | |||

Original bid | Alternative bid | ||

Hyflux | 0.45 | - | |

Keppel Seghers/Beijing Enterprises Water Group | 0.67 | 148.89% | |

United Engineers NeWater/IDE Technologies | 0.93 | 206.67% | |

Leighton Engineering & Construction/Tadagua | 1.35 | 0.62 | 300.00% |

Sembcorp Utilities | 1.42 | 1.4 | 315.56% |

Sembawang Equity Capital | 1.59 | 353.33% | |

YTL Power International Berhad | 1.64 | 364.44% | |

Spanish Befesa Agua | - | - | |

Source : https://www.desalination.biz/news/0/Eight-bidders-for-Singapores-second-desalination-plant/5583/ | |||

24 February 2019 Update

Hyflux has obtained court's approval to hold scheme meetings for creditors to vote on April 5. First with the senior unsecured creditors which will include the banks and medium-term noteholders; thereafter, with the subordinated debt holders that will involve the 34,000 perpetual security and preference share investors. Trade creditors of the three subsidiaries will have their scheme meeting on Apr 8.

There were active discussions in the market. Some appealed to the Government for financial assistance; others wanted the Government to intervene in Hyflux's restructuring process. Some called to boycott the coming scheme meetings; others appealed to investors to vote "No to Salim" as shown in this video.

However, "Saying NO to Salim" will mean Hyflux will have to liquidate its assets and investors may get peanuts or nothing in a fire sale. This will not help the poor and "ignorant" people, especially those who had been lured to part with their life time savings.

Hyflux's losses are mainly from TuasSpring's operation because they have tendered at a very low water price, 42% lower than SingSpring, resulting an annual difference of about SGD$38 million if there is no supplemented income from the electricity generation. One suggestion is for the investors to appeal to the Government to work out a solution to rescind the PUB/Hyflux's TuasSpring existing water contract @ a reasonable penalty to Hyflux. Thereafter, to allow a new tender to be called to reset the water price. In the new tender, the tenderers are allowed various options including taking over the TuasSpring at a reasonable cost to be agreed with Hyflux and its shareholders. PUB can always set a base price for the water supply for the new tender in order to protect the interest of the taxpayers' and the water consumers.

15 February 2019

Hyflux's losses are mainly from TuasSpring's operation because they have tendered at a very low water price, 42% lower than SingSpring, resulting an annual difference of about SGD$38 million if there is no supplemented income from the electricity generation. One suggestion is for the investors to appeal to the Government to work out a solution to rescind the PUB/Hyflux's TuasSpring existing water contract @ a reasonable penalty to Hyflux. Thereafter, to allow a new tender to be called to reset the water price. In the new tender, the tenderers are allowed various options including taking over the TuasSpring at a reasonable cost to be agreed with Hyflux and its shareholders. PUB can always set a base price for the water supply for the new tender in order to protect the interest of the taxpayers' and the water consumers.

15 February 2019

Many listed companies failed to survive or fall from the grace in the past because of poor business decision made. In the SGX Exchange, we have China Fishery Group, Noble Group and many others. The latest addition is Hyflux Ltd, a SGX listed water treatment company in Singapore.

Hyflux’s failure attracted a lot of attention lately. This is because as many as 34,000 investors took the opportunity to buy the bond issues raised by the Company in the past 4 years. The latest bond issue was the SGD$500 million 6% Perpetual Capital Securities (CPS) issued in 2016.

Only recently, the investors were told that the company was in heavy debt and its creditors were after them. Hyflux Ltd sold everything to an Indonesian company. The holders of perpetual capital securities and preference shares would get nothing except for the 267 million Hyflux shares contributed by the Board and Ms Oliver Lum.

Only recently, the investors were told that the company was in heavy debt and its creditors were after them. Hyflux Ltd sold everything to an Indonesian company. The holders of perpetual capital securities and preference shares would get nothing except for the 267 million Hyflux shares contributed by the Board and Ms Oliver Lum.

The Blaming Game

Many articles attribute the failure of the company to Corporate Governance and blamed “the company and its Board for failure to pay enough attention to the finances” . However, some took it personally and attributed the failure to the founder, Ms Oliva Lum, for making poor executive decisions. On the other hand, the company blamed the “prolonged weakness” in the local power market as the reason for the losses. Meanwhile, the public, especially those 34,000 investors, continued to bombard everyone including SGX and the Singapore Government for the lax in the "policing", resulting them to lose a lot of money in the company. While the blaming game is still going on, no one knew what exactly happened and no one bothered to ask.

What Could Have Possibly Gone Wrong?

It would become very clear if one has the following information put together

1. It was reported that for the Full Year ended in Dec 31, 2017, the TuasSpring which is an integrated water and power plant registered a net loss of S$81.9 million, with wholesale electricity prices clearing at levels that are below fuel costs;

2. The contract price for the supply of desalinated water for SingSpring was set at SGD $0.78 per cu metre whereas for TuasSpring, it was set at SGD$0.45 per cu metre.

For information, SingSpring was the first desalinated water plant installed by Hyflux and now come under the management of CitySpring which is a company under the wing of Temasek. TuasSpring is the second desalinated water plant which has an integrated 411 MW power plant. The water contract price was set by a tender called by PUB to supply desalinated water over a 25 year period.

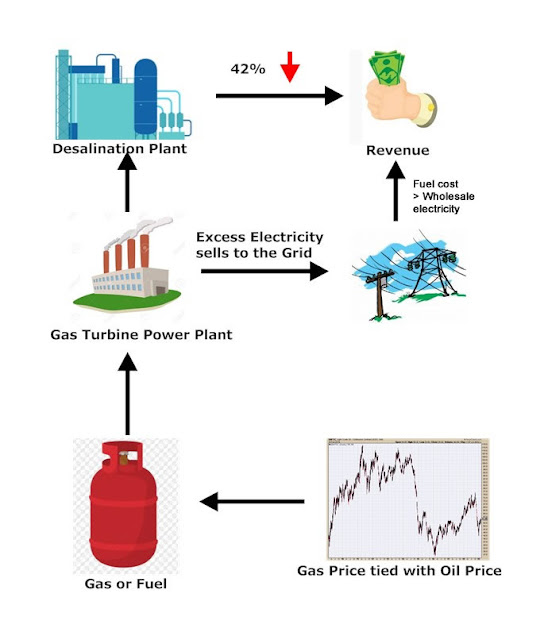

It is possible that in order to secure the contract to build the TuasSpring, Hyflux purposely lowered the contract price by 42% from SGD$0.78 to SGD$0.45 per cu metres. Note that at the time of PUB tender preparation around 2010, the oil price was about USD$60-80/= and poised to move higher and higher. Therefore, they could have expected the wholesale electricity price to rise as oil price went up. Having used very efficient Gas Turbine Generators, they could enjoy the cheaper self-generated electricity with the excess electricity selling to National Grid to earn enough revenue to supplement the lower revenue from the sale of the water supply.

The annual design capacity of the TuasSpring was 116 million cu meters per year, so the yearly difference in water revenue will be around SGD$38 million per year if there is no supplemented income from the electricity generation.

The annual design capacity of the TuasSpring was 116 million cu meters per year, so the yearly difference in water revenue will be around SGD$38 million per year if there is no supplemented income from the electricity generation.

What Actually Happened?

There was a crash in the oil price. The WTI Light Crude Oil Price dropped 75% from about USD$110 to about USD$27 for the 2-year period between 2014 to 2016, That was a year after TuasSpring has gone online in 2013. This must have affected badly the sale of electricity from the power plant resulting “wholesaleelectricity prices clearing at levels that are below fuel costs”. Note that although TuasSpring power plant is Gas Turbine driven, gas price is always contractually tied to the oil price.

Was This Vital Information Available?

At the time when Hyflux Ltd floated the SGD$500 million 6% CPS in 2016, the oil price had already collapsed to USD$27/=. So such information was available.

In its prospectus for the 6% CPS in2016, Hyflux has also disclosed with the following statement

1. With the substantial completion of the Tuaspring plant construction, the Singapore marketcontribution reduced to 38 per cent. or S$168.9 million in FY2015, down from 72 per cent.or S$232.6 million in FY2014.

2. The Group remains cautious on the outlook for the water and energy market in 2016, amid depressed oil prices, slower economic growth and volatility in global markets. If the current challenging market landscape of low Singapore electricity prices continues, the Tuaspring power plant is expected to incur losses in 2016. As part of its asset light strategy, the Group will continue to explore divestment opportunities to recycle capital for growth

The company has also disclosed the financial position in their annual reports etc vis-a-vis the revenue collected from TuasSpring. The only thing that was not disclosed or explained properly is how the oil price will affect the revenue of the company as illustrated below.

Lessons to Learn

The Web is full of articles about the lessons to be learnt from the fall of Hyflux especially when everyone knew that Hyflux was debt ridden and there were many “red” flags showing up in their financial statement. The high net-gearing ratio is one of them and the cash flow problem is another. The question remains even today is why investors were still interested to give Hyflux the money?

It is believe that the information available were located all over different places. They were not collected and laid properly on the “table” for investors to make a good decision. Therefore, bulk of the investors, especially the general public, have placed the “bet” that Hyflux Ltd would turn around despite all the adversity and discouraging news. Besides, water is scare resource and there is no question about the sale of water to PUB. Perhaps, not many were aware that the pricing strategy of Hyflux Ltd to set water price of TuasSpring 42% lower than SingSpring.

Disclaimer: This article is for information and educational purposes. Readers are advised to conduct their own research and study to make their own investment decisions.

Disclaimer: This article is for information and educational purposes. Readers are advised to conduct their own research and study to make their own investment decisions.

No comments:

Post a Comment