Jump to article

7 September 2023

SembCorp closed yesterday with a price of S$ 5.08 which is 2.7% down from Tuesday's closing price of S$ 5.22. SembCorp's price has lost a total of S$1.01 or 17% since 7 August 2023 when the news about SembCorp being listed in MSCI Singapore was first spread in various forums.

This article will try to find out where SembCorp's price might be heading.

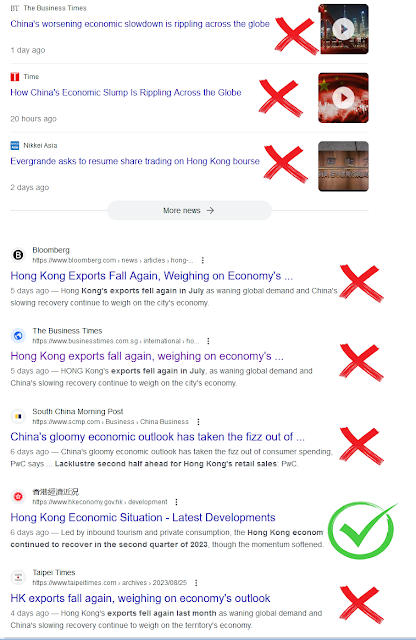

The reason why SembCorp’s Price was Falling

In the last article dated 1 September, we explained that Sembcorp stock demand would increase when it rejoined the MSCI index. This is due to an effect called S&P Phenomenon. Unfortunately, this S&P Phenomenon did not cause SembCorp’s price to rise but fall because the MSCI Singapore had not been performing to its best lately.

Will SembCorp’s Price Rise Soon?

Many traders were expecting SembCorp’s to rise sooner because it has fallen quite a lot and SembCorp has reported a sterling result for 1H2023 Some even speculated the price would rise even faster and quicker than before if history can repeat itself. Let’s examine in this article if this is possible from the angle of Technical Analysis.

Technical Analysis

Unfortunately, the Technical Analysis from the following chart is telling us a different story. This is because there are at least 3 weaknesses in SembCorp's technical chart.

First, we see a dead cross with 20-day MA cutting below 50-day MA; then, we see:

- The price cut below the 100-day MA;

- A bear flag formed with a target price below S$ 5.00

Fortunately, the 100-day and 200-day are still rising. This will give hope that SembCorp's price might have a chance to reverse its course if the prevailing condition is favorable.

|

| Click to enlarge the picture Figure 1 |

What about the Prevailing Conditions?

|

| Click to enlarge the picture Figure 2 |

|

| Figure 4 |

Given the above, we are expecting SembCorp's price to drop further to test not only Support S3 @ S$ 5.01 but also Support S4 @ S$ 4.86 as shown in Figure 1 above. If these 2 supports cannot hold the fall, the price might test the bear flag target price @ S$ 4.58 which happened to be also the Support S5.