09 February 2025

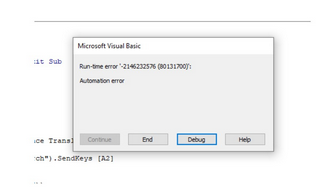

It will be frustrating when one has just built or upgraded the PC with a new motherboard just to find that the motherboard could not detect the dedicated GPU (giving 5 beeps on the speaker) and therefore, could not boot up or post anything on the screen. One could spend hours and hours trying to figure out what could go wrong. This is especially true when one has been using a CPU that did not have integrated graphics and could not boot up using the motherboard onboard Graphics There is just nothing on the computer screen that could help the troubleshooting. If you are lucky enough to use the onboard Graphics to boot up the PC, you might be faced with this warning sign.

Why it is so?

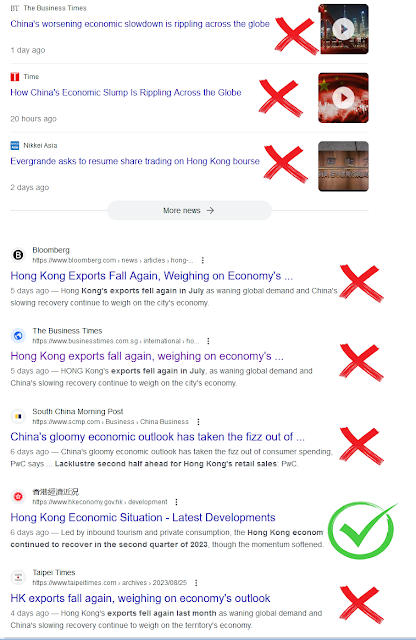

There could be many reasons but if the PC can boot up normally using a more recent GPU such as Geforce GTX950, it is most likely that the GPU in question does not have UEFI VBIOS in them. This GPU might not be compatible with the motherboard which was set to run on UEFI mode and would not work with any older peripherals that do not have UEFI in them.

What is the Work Around?

1) Upgrade the GPU's BIOS

The purpose is to upgrade the Bios of the GPU to include the UEFI function. This is not always recommended. There are plenty of materials on the Net and there is also one free BIOS Tweaker available to flash the Bios.

2) Change or Edit the MotherBoard Bios

It is usually recommended. It should always be the first step to take before trying to find other solutions.

a) For those who can boot up using onboard graphics

1) Power off and remove the dedicated GPU.

2) Power on and boot up to the post screen and enter into the bios by hitting F2 or Del as instructed; the bios screen will show up (using Gigabyte Z590 Pro Ax as an example)

3) Navigate to the Boot Tab and then click or select the CSM support and enable it

4) Click the 'Save and Exit' Tab & select Save & Exit Setup to Exit Bios

5) Restart the PC and check the Boot Tab to see if the CSM. If CSM is enabled, shut down the PC, and with the power off, insert the dedicated GPU in the correct PCIe slot. If there is more than one PCIe slot, insert the dedicated GPU in the 'black slot'. Try other slots to see if the PC can detect the GPU card. When CSM is enabled, it will usually fix the problem; if not, try b) below.

b) For those who can't boot up using onboard graphics but can boot up the PC using a more recent GPU like GTX950 that has UEFI VBios

1) Power off; erase and refresh the CMOS by removing the CMOS battery and short-circuiting the CMOS's 2-pin jumper as instructed in the manual;

2) Restart the PC and check if the PC can boot up through the dedicated GPU; if not, one might have to replace the GPU with a compatible GPU like GTX950 which has UEFI VBios. Once booted up, quickly enable the CSM by following the steps as described in 2(a). Once it is confirmed that the CSM can be enabled in the Bios, shut down the PC and then change back the GP. Restart the PC to check if the PC can detect and post something on the screen; if not, continue to 2 (b) (3);

3) Reflash the motherboard with the latest bios

Download the latest bios from the manufacturers' webpage. In the case of Z590 Pro AX, it is in here and the latest bios is F11. Google and find from either the manufacturer's website or find YouTube video on how to refresh the motherboard. Be very careful to follow the exact instructions as a wrong step taken might brick the PC motherboard. In the case of Gigabyte Boards, it is recommended to use the 'Q-Flash Plus" as it is easy and safe.

4) Once the Bios is reflashed, put everything back in order, insert the dedicated GPU card, and restart. Check if the problem has been fixed; if not, try 2(b) (2)

c) In case, the PC cannot even boot up using a more recent GPU like GTX950 that has UEFI VBios and the motherboard Bios have been reflashed

Most likely the motherboard is toasted or there are some problems with peripheral cards or devices or RAM or CPU or there are other incompatible components that prevent PC from booting up. Troubleshoot, remove, and replace these components.